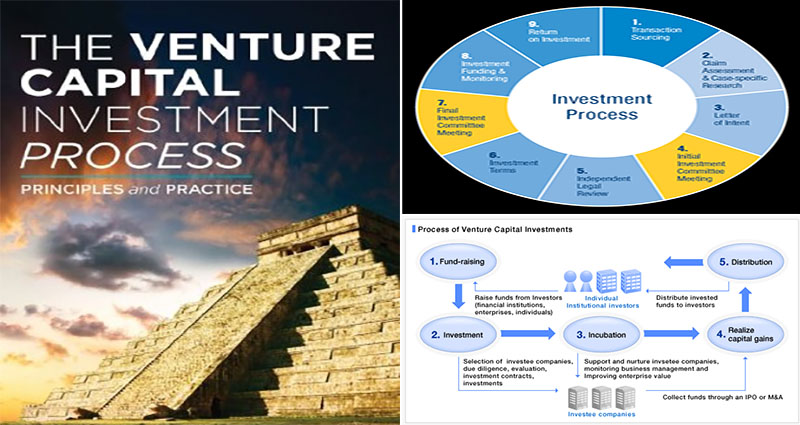

The Venture Capital Investment Process

The initial phases of the VC process involve the look for investment possibilities and evaluating management teams. Afterward, the venture firm allocates its capital to businesses with powerful prospects. Most VC firms will hold a minority stake within the firms they invest in. Because of this, they will be far more most likely to become in a position to retain the high-quality people today on their Board of Directors. Additionally, the initial investment process involves a thorough assessment of the company’s business model, the marketplace potential, and the item or service.

Startup Stage

The initial stage of an organization comes immediately after the seed or startup stages. The item is now offered in the marketplace as well as investors can see how it performs. The initial stage also involves additional sales and manufacturing. The level of investment at this stage might be larger than in the preceding stages. The company requires to hold its own against the competitors and ensure that the new item can hold its worth. Within an initial couple of years of its life cycle, the business may have a likelihood to prove itself.

The Initial Stage

The subsequent stage of an enterprise is the 1st stage. This occurs immediately after the seed or startup stage. At this stage, the solution has already been developed and is out there within the market. This allows the investors to find out how it performs within the marketplace. Within this phase, the organization could also need added marketing and advertising, … READ MORE ...

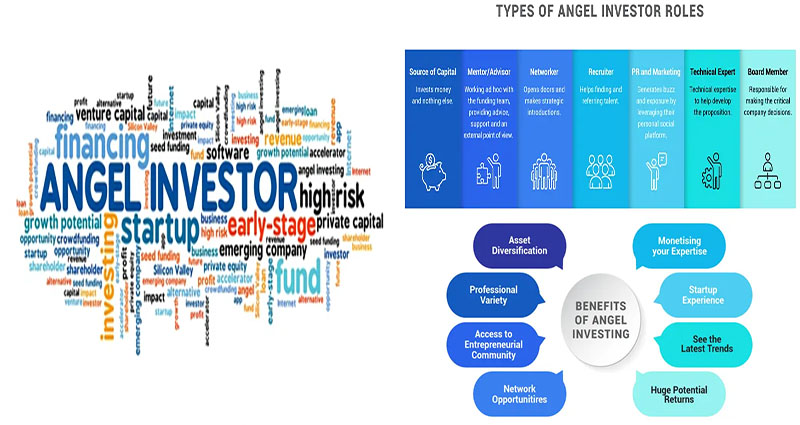

How Do Angel Investors Help Startups?

The most effective solution to uncover angel investors for startups is to get in touch with quite a few groups, every of which specializes in a specific field or industry. It is crucial to choose a group that’s appropriate for your startup. Take into account that not all angel investors are produced equal. Your startup’s achievement will rely on the options you make, and not all investors are perfect for you. Listed below are some suggestions for obtaining the ideal angel investor.

Know What You Would Like

Be clear about what you happen to be selling and how you plan to make use of the money. When you never have a clear concept about how you are going to make use of the funds, you’ll likely shed their interest. It is much better to have a business enterprise strategy and perform tough to generate it. You ought to also be ready to pitch your idea to a wide variety of investors. Getting an investor’s name attached for your project does not mean that you are going to succeed.

Getting a Solid Concept for Your Small Business is Important

You must have a clear thought of what you’re selling, and how you intend to work with the money to grow. If you’re not positive, don’t ask for revenue without a strong strategy. If your pitch doesn’t seem viable, you might lose interest and shed your opportunity to raise capital. To have probably the most out of an investor, you have to … READ MORE ...

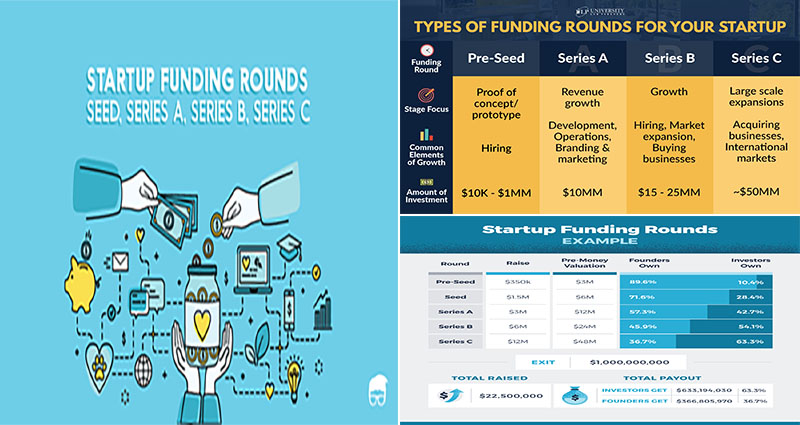

How to Get Seed Funding For Startups

Seed funding investors generally invest in early-stage ventures with high-risk prospective. This type of financing is created for startups using a viable item or service. Ahead of approaching a seed funding investor, make sure you realize the business model along with the costs linked with consumer acquisition and retention. In case you are unsure, use economic modeling tools or existing relationships to establish the likelihood of your product’s results. On the other hand, recall that this kind of investment entails higher danger.

The Market Prospective of the solution

Before picking a seed fund investor, entrepreneurs will have to be able to demonstrate the market prospective of their solution or service. They will have to explain how they will generate income with the item or service. Besides, investors desire to realize that the team is capable of functioning around the idea. Although you will discover several different seed funding avenues, the most regular route is through Venture Capitalists, a firm constructed particularly to supply funding to start-ups.

Preparing to Give Up Some Equity to Obtain Seed Funding

Aside from presenting the business program, entrepreneurs ought to prepare to give up some equity to obtain seed funding. An investor needs to be able to calculate a company’s market value determined by its equity structure. To do this, they will have to prepare a capitalization table that details all of their equity ownership capital. This table needs to show the total funding amount at various stages of development, person investment amounts, ownership shares, … READ MORE ...

Advantages of Venture Capital Example

VCs are normally far more willing to invest in corporations together with the guarantee of a higher return on investment than those that don’t. In exchange for equity within the enterprise, VCs will supply particular guarantees and incentives to investors. These guarantees might incorporate a minimum percentage on the company’s revenues and also a stipulation that the firm can not invest more than $X per share devoid of getting approval from the VC. This can be significant mainly because a VC’s approval is typically necessary for specific conditions. Besides granting funds, VCs may also give their knowledge and connections in the sector to startups that have received funding from them.

Expanding the Inventory and Boost the Sales

When a corporation has received venture capital, it can put the money into manufacturing and delivering merchandise or services. Whilst the management is expected to help keep a close eye around the small business, the investment group is anticipated to maintain a close eye on it, enabling them to take care of the competitors from peer organizations. These organizations will make use of the funds they acquire from their venture capitalists to expand their inventory and boost their sales. However, a handful of venture capitalists is willing to create investments throughout the initial study and improvement phases.

Helping for Most Significant Investment Returns

Venture capital has helped lots of thriving providers and developed a number of the world’s most significant investment returns. The current big winners of venture capital are Facebook, Apple, Amazon, … READ MORE ...

How to Find Angel Investors

When most entrepreneurs have access to a network of investors, there is still a high barrier to entry for startups. Irrespective of the size of one’s startup, locating the best angel investors will likely be important for any successful launch. This article will provide you with some suggestions and guidance to help you find the appropriate ones. The next step would be to recognize which sort of investor you happen to be seeking. Initially, study the distinct types of angel investors. Check their portfolios and check irrespective of whether they’re searching for any new venture. You may also ask to find referrals. In the event, you have no notion who to strategy, you’ll be able to send them cold emails or social media outreach.

Getting Angel Investors

In terms of getting angel investors, you may need to know what they are seeking. There are a variety of varieties, so you’ll want to start by doing your study and identifying the ones who’re most enthusiastic about your business. You will find some industries that attract plenty of angel investors, like computer software and the web. If you’re in the genuine estate market, you are going to need to have some expertise in the business to find the appropriate particular person to invest in.

Be Certain You’re Clear About What Your Enterprise Is All About

An angel investor will choose to understand how the funds will probably be employed and will possibly wish to be involved in all of the choices you … READ MORE ...