Enterprise Incubators And Venture Capital Firms Welcome UK Government’s Announcement On Visas For Begin

Angel investors, venture capital firms, and private firms all going to see a nicely written business program as it relates to your intended startup operation. David H. Hsu (2004), What do entrepreneurs pay for venture capital affiliation?”, Journal of Finance, Vol. Frequently, these Retail Venture Capital funds only invest in businesses exactly where the majority of personnel are in Canada. In addition, if your venture has possible synergies with a portfolio enterprise, this substantially enhances the VCs interest in your firm.

Angel investors, venture capital firms, and private firms all going to see a nicely written business program as it relates to your intended startup operation. David H. Hsu (2004), What do entrepreneurs pay for venture capital affiliation?”, Journal of Finance, Vol. Frequently, these Retail Venture Capital funds only invest in businesses exactly where the majority of personnel are in Canada. In addition, if your venture has possible synergies with a portfolio enterprise, this substantially enhances the VCs interest in your firm.

Venture capitalists are pretty selective and extra frequently than not has strict requirements. A pair of Los Angeles start off-ups are hunting to fill the entertainment gap in between standard-problem smartphones and bulky video game consoles. Conversely, some VCs concentrate on giving capital to firms to bridge capital gaps before they go public.

This caste method is a single of the secrets of the venture capital firms in America. Dimo Dimov, Dean A. Shepherd, Kathleen M. Sutcliffe (2007), Requisite expertise, firm reputation, and status in venture capital investment allocation decisions”, Journal of Enterprise Venturing, Vol.

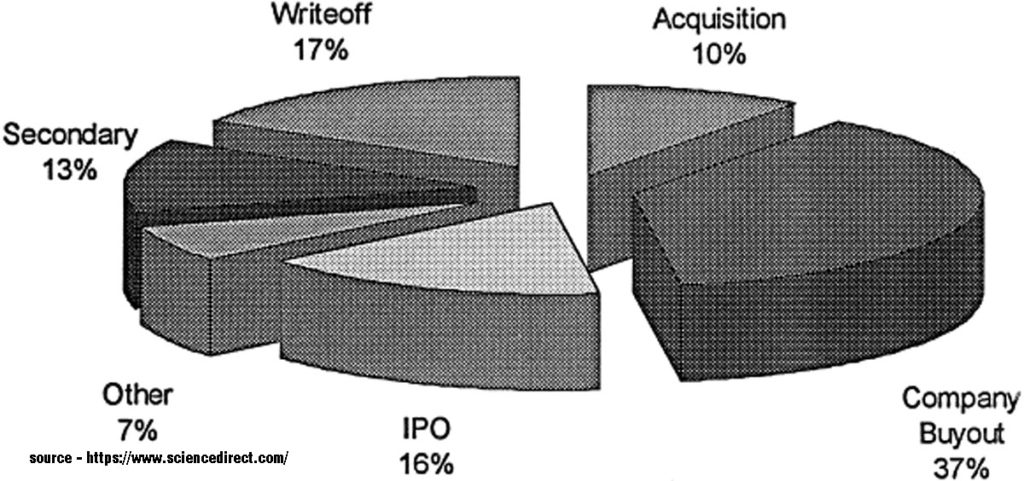

Exit of venture capitalist: VCs can exit through secondary sale or an IPO or an acquisition. The sitcom Silicon Valley parodies startup firms and venture capital culture. All through the 1970s, a group of private equity firms, focused primarily on venture capital investments, would be founded that would turn out to be the model for later leveraged buyout and venture capital investment firms.

In fact, the principle behind capital investment is that higher is … READ MORE ...

Headquartered in San Francisco, Walden Venture Capital targets Sprout Stage investments. Divide the estimate of the total dollar return the venture capitalist wants by the projected marketplace worth of the corporation. The bulk of the terms will remain the similar, or get worse, via successive rounds. This step can contain building a term sheet describing the terms and conditions beneath which the fund would make an investment.

Headquartered in San Francisco, Walden Venture Capital targets Sprout Stage investments. Divide the estimate of the total dollar return the venture capitalist wants by the projected marketplace worth of the corporation. The bulk of the terms will remain the similar, or get worse, via successive rounds. This step can contain building a term sheet describing the terms and conditions beneath which the fund would make an investment. 1 of the increasing trends in the venture scene is the addition of family offices to the mix of prospective investors. Female Founders Fund is proper there with them, stating that standard venture capital does not take into consideration that females entrepreneurs knowledge a lot more successes than their male counterparts. The late 1990s had been a boom time for venture capital, as firms on Sand Hill Road in Menlo Park and Silicon Valley benefited from a massive surge of interest in the nascent Net and other laptop technologies.

1 of the increasing trends in the venture scene is the addition of family offices to the mix of prospective investors. Female Founders Fund is proper there with them, stating that standard venture capital does not take into consideration that females entrepreneurs knowledge a lot more successes than their male counterparts. The late 1990s had been a boom time for venture capital, as firms on Sand Hill Road in Menlo Park and Silicon Valley benefited from a massive surge of interest in the nascent Net and other laptop technologies.