Using a Venture Capital Valuation Calculator

Before we start talking about the Comparables method, it is essential to understand the Pre-money valuation. This valuation method is very similar to the Cost-to- duplicate method. However, there are some differences between them. Ultimately, the Value-at-Risk (VAR) method is the most appropriate one to use. Let’s go over each of them in detail. Using the Value-at-Risk (VAR) method as the starting point will yield a maximum pre-money enterprise valuation of $2.5 million.

Pre-money valuation

A pre-money valuation is a number assigned to a company before it raises venture capital. It can vary significantly, ranging from three million dollars to over nine million dollars. The founders and venture capitalists typically use their own interpretation of this figure, and it may differ from the value assigned to the company after it raises a round of funding. The valuation method should be used in conjunction with a variety of other factors, such as the company’s performance and market size, as well as the company’s competitors.

In the startup world, a pre-money valuation is used to determine a company’s value before a new investor comes in. The valuation is often negotiated and is a proxy for the enterprise’s value. It differs from the market, income, and cash methods, as it does not account for the new capital the business will receive from investors. It is important to note that this method is not a substitute for an income-based valuation.

Cost-to-duplicate

The Cost-to-Duplicate method of startup valuation is a powerful way to value a … READ MORE ...

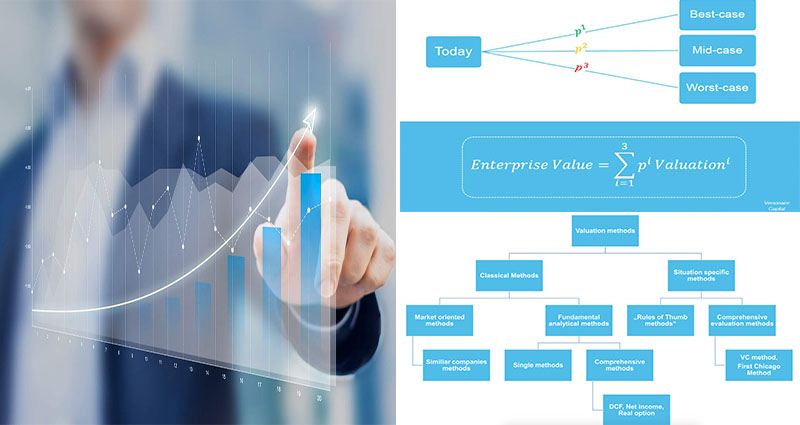

If you have ever wondered about these and related queries, be confident to join us for the subsequent T3 program, on Tuesday, April 5th. Since the VC considers itself committed for the entire investment in Year , the VC does not discount the damaging cash flow in Year 1. The absence of adverse present values of totally free money flows in Years and 1 reflects the full investment in Year . As a result, the worth at time t= is a post-dollars valuation.

If you have ever wondered about these and related queries, be confident to join us for the subsequent T3 program, on Tuesday, April 5th. Since the VC considers itself committed for the entire investment in Year , the VC does not discount the damaging cash flow in Year 1. The absence of adverse present values of totally free money flows in Years and 1 reflects the full investment in Year . As a result, the worth at time t= is a post-dollars valuation.