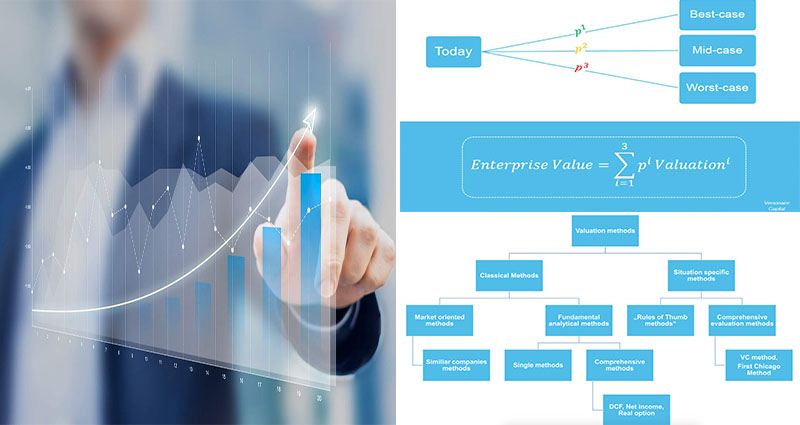

A variety of venture capital valuation methods exist, along with the most generally utilized may be the Initially Chicago Method. This method combines elements of discounted money flow and multiples-based valuation and is utilized by private equity and venture capital investors to worth their investments. The initial Chicago Approach focuses on the future growth prospects with the enterprise instead of its current operating expenses. Even so, it might not be acceptable for all circumstances. This strategy has been verified to be inaccurate in some instances.

The Revenue Strategy:

The revenue strategy would be the most extensive strategy for valuing corporations. The idea should be to project future money flows for more than an extended period, including the not-foreseeable future. These future money flows are then discounted towards the present applying a proper price. The outcome is the intrinsic worth of a small business primarily based on its cash-generating possible. The key challenge of your Revenue Method is accurately forecasting the money flows for the target enterprise. This can be tricky, but using a bit of understanding, the course of action may be performed efficiently.

The Earnings Strategy:

This can be the most extensive technique of all. This strategy consists of projecting future money flows for more than an extended period. This technique is speculative since the cash-generating perspective of your business is only several years out. But it is a terrific option for startups in the growth stage. Within this stage, the founders from the corporation are looking to ascertain their product/market match. They ordinarily raise a series A funding round of $2-$5 million.

Danger Assessment:

The Threat Aspect Summation Approach entails taking into account the effects of company risks on the possible return on investment. The system utilizes an estimated initial value and then adds the effect of various company risks to it. This method just isn’t suitable for early-stage startups. For this reason, numerous startups depend on the VC Technique. Nevertheless, it still represents the most effective option for startups. You will find many different other methods out there, along with the VC Model is just among them.

The Danger Summation Process:

This process includes taking into consideration the pre-money valuation of a pre-revenue startup. The danger summation method has many positive aspects, but it is just not suggested for all businesses. Some venture capital investors will look for pre-money valuation to avoid overpaying for pre-revenue. However the most significant benefit of this approach is the fact that it could also be employed within the early stages, that is when the startup is still in the development phase.

The VC Technique:

This process entails discounting the future value of your firm. The post-money valuation is primarily based on the pre-money valuation, plus the new financing raised within the type of equity. It is a popular approach for early-stage venture providers. It aims to make sure that they create an acceptable return. There are some disadvantages, nonetheless. Probably the most crucial is that it needs high-quality information. Additionally, if it’s not profitable, it is not worth investing in it.