The Different Types of Venture Capital Firms

There are many types of venture capital firms. Listed below are the different types. Startup Capital, Expansion Capital, and Late Stage Capital are just some of them.

Each one has its own unique set of characteristics. To find out more, read on! To get started, you’ll need a little bit of experience in your field. Seed Capital is the most common form of venture capital. It offers the earliest investment, while late-stage capital focuses on growth and expansion.

Seed Capital

In 2014, there were 138 active Seed Funds. To qualify, a firm had to make four unique seed investments in that calendar year. This figure excludes corporate VCs, including Google Ventures. But it’s clear that the number of seed funds has been increasing over the past several years. There are some differences between seed funds and their larger counterparts. Here are a few key differences to keep in mind.

Startup Capital

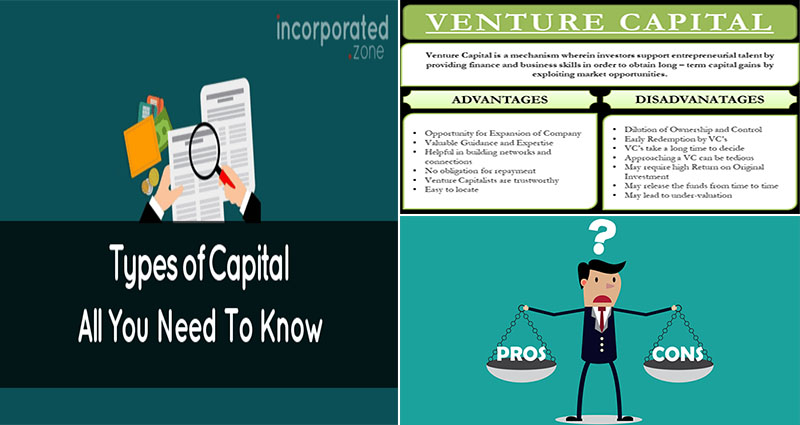

There are several types of venture capital firms. The first venture capitalist was George Doriot, who actively participated in the development of a startup, providing funding, counsel and connections to entrepreneurs. Since then, the VC industry has consolidated around Doriot’s original philosophy. The primary difference between venture capital firms and other forms of funding is the level of expertise and the size of the portfolio. The difference between venture capital and other forms of funding is reflected in their valuations and terms of investment.

Expansion Capital

Expansion Capital is a kind of private equity investment that some companies put … READ MORE ...