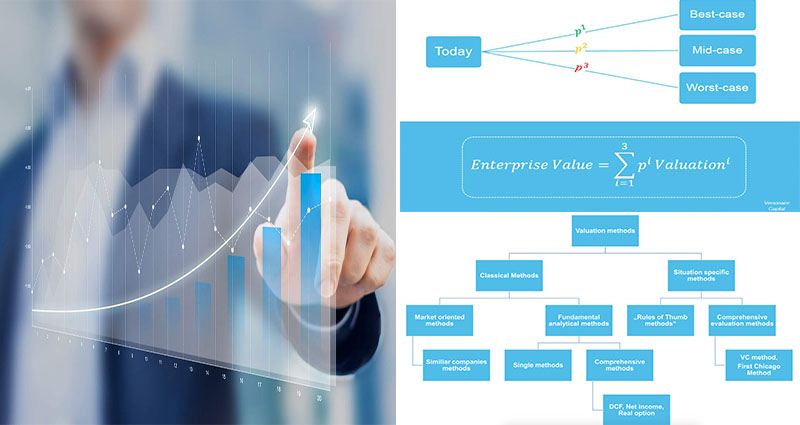

Venture Capital Valuation Methods

A variety of venture capital valuation methods exist, along with the most generally utilized may be the Initially Chicago Method. This method combines elements of discounted money flow and multiples-based valuation and is utilized by private equity and venture capital investors to worth their investments. The initial Chicago Approach focuses on the future growth prospects with the enterprise instead of its current operating expenses. Even so, it might not be acceptable for all circumstances. This strategy has been verified to be inaccurate in some instances.

The Revenue Strategy:

The revenue strategy would be the most extensive strategy for valuing corporations. The idea should be to project future money flows for more than an extended period, including the not-foreseeable future. These future money flows are then discounted towards the present applying a proper price. The outcome is the intrinsic worth of a small business primarily based on its cash-generating possible. The key challenge of your Revenue Method is accurately forecasting the money flows for the target enterprise. This can be tricky, but using a bit of understanding, the course of action may be performed efficiently.

The Earnings Strategy:

This can be the most extensive technique of all. This strategy consists of projecting future money flows for more than an extended period. This technique is speculative since the cash-generating perspective of your business is only several years out. But it is a terrific option for startups in the growth stage. Within this stage, the founders from the corporation are looking to ascertain … READ MORE ...