Venture Capital in Entrepreneurship – Venture Capital Fund Example

The first and most important venture capital fund example is the USV. The company beat out four other VC firms and was selected by its investors for the investment thesis they had developed. The investment thesis outlines the company’s philosophy and strategy in the future and is a publicly published document. The following is a more detailed description of this particular example of a venture capital fund. It is also an excellent learning tool. The following is a detailed analysis of the USV’s business plan.

The Most Important Step In The Process Is Valuation

The first step is to determine the value of the business. There are two types of valuation: pre-money and post-money. A pre-money valuation refers to the value of the company before any new funds are invested. The post-money valuation is the value at the end of the funding period. In this case, a $5 million investment would require a $20 million post-money valuation and a 25% stake in the company.

The Next Step Is To Evaluate The Feasibility Of Each Venture

VC investments tend to be long-term, which is good for the investors. The startups they fund take years to mature and grow in value. VCs are often reluctant to close their funds or liquidate their investments because they believe the business will be a big winner. However, these investors are paid a fee for their management, which reflects a predictable pattern of capital allocation.

The Valuation of The BusinessiIs Critical in the VC Process

In … READ MORE ...

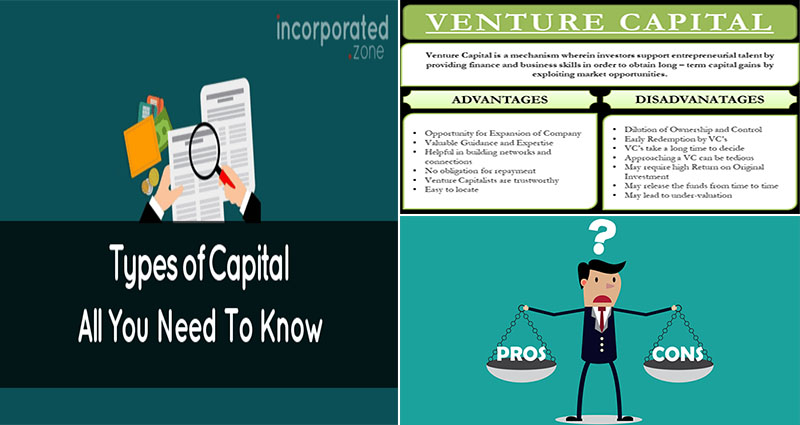

Types of Venture Capital Advantages and Disadvantages

You’ll find various types of venture capital. First-stage financing is a kind of early-stage funding that provides new businesses together with the required seed dollars to develop and marketplace their solution. Second-stage financing supplies enterprises with the funds to scale up, enter new markets, and improve promoting efforts. These types of financing are generally structured as debt or preferred stock, but typically have a higher rate of interest than earlier stages. For these causes, it can be crucial to understand the differences between the two.

Later-stage funding is presented to companies that have accomplished commercial results but are not however profitable. Bridge funding also referred to as mezzanine financing, aids smaller enterprises spend for short-term expenditures before an IPO or initial public providing. The corporations are usually high-risk/high-return and possess a history of producing a profit. You will discover two types of venture capital. Listed below are the key differences between the two.

The Very First Is Early-Stage Funding

This kind of capital is offered to new businesses having a strong opportunity of becoming sold. Lots of investment bankers are on the lookout for high-growth firms. This type of investment will normally create a big commission. These commissions can attain six to eight percent from the quantity raised via an IPO. VC investors typically look for high-risk/high-return enterprises. If these elements are present in your business enterprise, it can be crucial to locate the proper kind of funding.

Late-Stage Funding

It is supplied to corporations that have already accomplished commercial … READ MORE ...

Entry Level Venture Capital Salary

There are many distinctive kinds of entry-level venture capital jobs. The bed oddball encounters first is an associate position, plus the next is an analyst position. These positions usually do not hire straight out of undergrad. These positions need entrepreneurial, as well as quantitative abilities. Because the name suggests, you are going to perform using the investment group, sourcing deals, and drafting investment memos. In several situations, you will discover no formal requirements to work as an associate.

A Profession in Venture Capital May Be Challenging, But It’s Also Rewarding

Even though several individuals dream of operating for the most significant firms, they may be normally not prepared for the demanding demands of this profession. While salaries for entry-level venture capital jobs are low when compared with other fields, a lot of leading business enterprise school graduates have found a fantastic way to start a career in this fast-paced business. In addition, these entry-level positions are flexible and can bring about more lucrative positions down the road.

The Next Kind Of Entry-Level Venture-Capital Job Is Life Science.

It requires a Ph.D. and needs a wealth of scientific expertise and passion for the field. Having said that, even if you happen to be not an academic, you can nevertheless come across entry-level venture capital positions in these fields. The salaries for these positions are primarily based on the level of capital you invest and whether or not or not you are a fantastic match for the business.

As an entry-level … READ MORE ...

Do You Trade for Pips Or Profits?

If you ask currency traders this question, 90% of them will answer for profits. That is why there is a 10% success rate in Forex. Traders who are among the 10% success rate like to trade for pips. They do not care for profits or gains. To them, efficiency and consistent profits have the most priority. If you are a novice trader, embrace this idea. It will help you develop a positive trading mindset for Forex. When you concentrate on pips, you will have a better awareness of the market conditions. It also helps to choose the best pairs to trade. Moreover, traders understand the necessity of risk management.

A strong trading mindset always focuses on the outcome from signals. To succeed in Forex, forget about profits. Instead of it, take your time and establish a strong trading technique with efficient tools and strategies. To improve skills, use a demo account and practice your plans with demo trades. It helps to understand flaws in your approaches.

Prioritize good trade signals

To attain pips in trades, you must find good signals. And for that, you will need extensive market analysis. Both technical and fundamental analysis is crucial for an efficient market study. So, one must understand both to improve efficiency. A demo account is the best place to learn market analysis. As technical analysis is sophisticated compared to fundamental analysis, traders can spend countless hours learning it. You can also study the fundamentals of the market movement. Thus, you can establish … READ MORE ...

Joint Venture Strategy in International Business

Joint ventures are a wise strategy to get a business having a restricted amount of resources. It can assist you to expand into a brand new marketplace and make use of a partner’s experience or assets. Having said that, if the two partners have various skills and experiences, you must look at setting up an automatic trigger to force the sale. This way, you can be sure that you’re meeting every companion halfway. Listed below are some considerations to remember.

A Joint Venture Might help You Gain Access To a brand new Industry

It makes it possible for you to develop more speedily and effectively. This strategy also can allow you to access new markets and distribution networks. It’s important to plan effectively ahead of getting into a new marketplace. The following are some variables to consider when developing a joint venture. The very first one, in particular, is the style of business you may have. Do you need to make a solution or service for a foreign marketplace?

Establishing a Strong Management Group And Employees

In a joint venture, every party will contribute a certain amount of capital, known as share capital. This initial capital will enable you to decrease the monetary burden of every organization. A prosperous joint venture will bring collectively a wide range of resources, which will assist lower the fees of running the joint venture. Inside a partnership, every companion will bring a specialized talent set to the table, which is very important for success … READ MORE ...