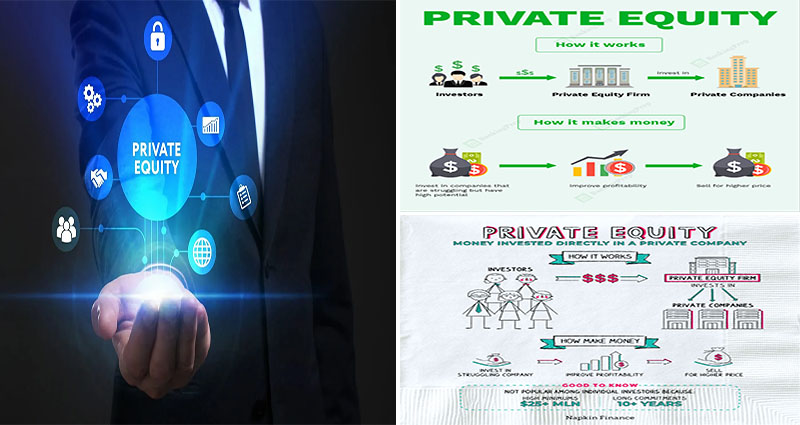

Types of Private Equity Example

A private equity investment is often a form of venture capital. This implies that the private equity investors will not be the company’s shareholders. As an alternative, they serve as advisors. These investors may offer management expertise and capital to portfolio corporations. Normally, private equity funds appear for providers that have an important potential for development. For example, they may require to enhance capital expenditure to attain a brand new buyer base or rethink their distribution tactic. Furthermore, fund managers may perhaps also guide an enterprise toward larger distribution networks and much more skilled management.

The Private Equity Investment Business’ Eras

The private equity investment business is divided into two distinct eras: the pre-2008 era well as the post-2008 era. The pre-2008 period was characterized by historically low-interest rates, favorable credit markets, and big amounts of debt financing. Consequently, there have been many massive buyouts, such as Toys “R” Us, Hertz Corporation, and Power Future Holdings, all valued at more than $44 billion. In contrast, the 2007-2008 era saw the largest LBOs in history, such as Hilton Hotels, Harrah’s Entertainment, and Hertz Corporation.

Private Equity is not for Everyone

Whilst private equity isn’t for everyone, it is an easy strategy to make larger returns than standard investing. Before investing inside a private equity fund, it truly is crucial to investigate the fund completely. Find out just how much it charges and what it is carried out in the past. Bear in mind that unregulated funds are usually not necessary to … READ MORE ...

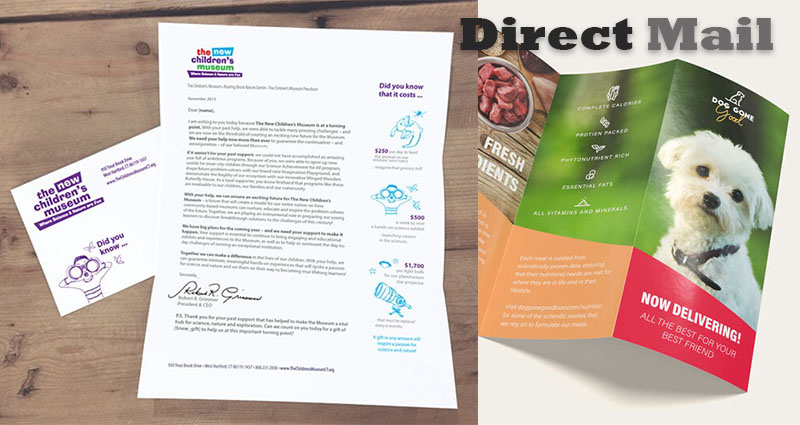

What is a Laminated Direct Mail? Unveiling the Truth Behind This Powerful Marketing Tool!

When strategizing your direct marketing efforts, it is important to consider how laminated mailers can help you get, and retain, customers. Laminated mailers are thicker than postcards and provide more protection for the message that you want to convey. It is also important to think about what you’re trying to accomplish with the materials before designing a mailer yourself. The key thing here is not only considering why you would use this laminated mailer, but why send these instead of regular postcards or fliers?

What is a laminated mailer?

- Laminated mailers are typically thicker, sturdier postcards or flyers.

- They provide more protection of the message you want to convey.

- Mailers are more expensive than regular postcards and fliers, but they last longer and can be reused when laminated.

Why use a laminated mailer?

- Laminated mailers protect your message from getting wrinkled or torn.

- Mailers and flyers provide a sturdier feeling than regular mailers.

- Laminated mailers and flyers can look more professional than regular mailers, which will gain your potential and current client’s attention.

Benefits of sending out a laminated mailer?

- They can be reused multiple times.

- They provide a more professional texture and feel than regular mailers. There are even those mailers that are ‘soft touch’ and provide better quality.

- Mailers and flyers look more professional.

Sending out a laminated mailer is an easy way to get your message in front of potential customers. If you need help to decide what type of content should be included … READ MORE ...

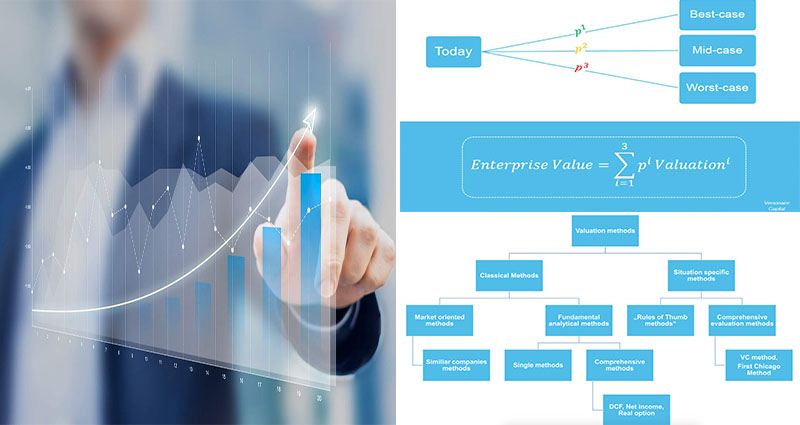

Venture Capital Valuation Methods

A variety of venture capital valuation methods exist, along with the most generally utilized may be the Initially Chicago Method. This method combines elements of discounted money flow and multiples-based valuation and is utilized by private equity and venture capital investors to worth their investments. The initial Chicago Approach focuses on the future growth prospects with the enterprise instead of its current operating expenses. Even so, it might not be acceptable for all circumstances. This strategy has been verified to be inaccurate in some instances.

The Revenue Strategy:

The revenue strategy would be the most extensive strategy for valuing corporations. The idea should be to project future money flows for more than an extended period, including the not-foreseeable future. These future money flows are then discounted towards the present applying a proper price. The outcome is the intrinsic worth of a small business primarily based on its cash-generating possible. The key challenge of your Revenue Method is accurately forecasting the money flows for the target enterprise. This can be tricky, but using a bit of understanding, the course of action may be performed efficiently.

The Earnings Strategy:

This can be the most extensive technique of all. This strategy consists of projecting future money flows for more than an extended period. This technique is speculative since the cash-generating perspective of your business is only several years out. But it is a terrific option for startups in the growth stage. Within this stage, the founders from the corporation are looking to ascertain … READ MORE ...

Insight Venture Partners Careers

Insight Venture Partners is usually a top international venture capital and private equity firm. It invests in providers that happen to be early-stage and is within the growth-stage stage. Its target sectors include things like mobile, the world wide web, big data, artificial intelligence, construction technology, and healthcare. The firm has raised much more than $8 billion in funding and has invested in a lot more than 200 growth-stage corporations. Insight’s portfolio has incorporated a wide range of organizations.

Insight Venture Partners is Usually a Diversified Firm

Its personnel is from a diverse selection of backgrounds. The enterprise is 51.2% female and 44.6% ethnic minorities. The firm’s workers are most likely to become Democrats, though it will not possess a big diversity of political parties. All around, staff members stay with the firm for a typical of 3.9 years. Insight features a total annual revenue of around $2 billion.

Salaries Differ Extensively at Insight Partners

Managing Directors earn $202,214 on average, though Vice Presidents and Controllers make a median salary of $57,077. Lower-level workers earn a typical of $26,515 per year. Insight Venture Partners’ staff is comprised of persons with diverse demographics. The company is mainly composed of Democrats, and its staff is 51.2% female. The typical length of employment is 3.9 years.

A High-Growth Venture Capital Firm

Insight Venture Partners can be a high-growth venture capital firm having a large presence within the New York market. The company’s personnel are primarily women, with 44.6% of them being ethnic minorities. … READ MORE ...

Small Business Funding Ideas

In terms of small business funding, you have a few solutions. Conventional banks can give you using a business loan, but you could not qualify for this type of funding. The most beneficial point to accomplish is to get in touch with your existing bank to inquire about the various selections that they provide. Or, look for a bank within your region. It is possible to use this guide to assist you to select the very best financing selection for your business. After you have a program in mind, you are going to need to locate a lender who can deliver the funds that you need to have.

The Most Typical Style of Small Business Funding

This sort of loan is obtainable to small firms having a superior track record and collateral. This kind of loan is perfect for short-term desires, but you could discover that you will need more money than you had originally planned. It is possible to also choose a longer-term loan when you require it for the business. Irrespective of your credit score, you must usually attempt to increase it ahead of applying for any bank loan.

Competitive Terms And Low-Interest Prices

Amongst essentially the most well-known choices for small business funding, bank loans have competitive terms and low-interest prices. To qualify, you’ll have to have to possess a good individual credit score, established business income, and be in business for at least two years. In most situations, regular banks can assist you to obtain a … READ MORE ...