Venture Capital Advantages and Disadvantages

When it comes to creating a venture capital investment, there are some key points to help keep in thoughts. The first could be the valuation of your business. Pre-money valuation refers to the value your enterprise has just before new revenue is invested, and post-money valuation refers to its worth soon after the new revenue has been invested. The investor will anticipate your company to be worth a minimum of

$20 million immediately after the funds are invested and can be enthusiastic about your company’s growth and progress.

The Second is The Exit Strategy

If you make an effective exit, you should sell your enterprise at the correct time. The objective of the exit technique would be to boost the valuation of your business. In the event the organization can retain up together with the competition and turn a profit, the VC can be a good decision. The following step will be to raise the capital to make the business more profitable. You may also ask your pals and household for some suggestions.

The very first step inside the exit tactic is to prove that the business enterprise has a huge addressable marketplace. VCs commonly invest in businesses that have massive and expanding addressable markets. The TAM of Uber grew 70x in 10 years, from a $4B black-car industry to a $300B cab market. This can be exactly where an enterprise will start the network impact, exactly where charges decrease as more customers make use of the service.

The Level

… READ MORE ...Capital Investment Group Companies

Capital investment companies are investment companies that present loans or equity investments to smaller and midsize corporations. Additionally, they supply other financial merchandise, like mutual funds. The mission of these companies is always to help these companies achieve their monetary goals. They’re also committed to making certain that the folks that perform for them are rewarded for their function. In case you are hunting for a new investment chance, contemplate operating having a capital investment enterprise. These companies are situated throughout North Carolina and are backed by venture capitalists.

A.Partners

On the list of earliest private equity companies was referred to as A.Partners. This corporation was founded by venture capitalist Alexey Soloviev. Yet another early venture capitalist, he is the founder and CEO of Winter Capital Advisors. In addition to private equity and venture capital, the company is also an investment advisory firm. The Finstar Monetary Group is an international company development investment company, which invests in fintech, media, and FMCG retail. A fourth capital investment business, Capital Investment Corp., merged with Nesco. The enterprise acquired a major specialty equipment rental provider with a concentrate on the electric utility and telecom finish markets. The deal also permitted Capitol to restructure its current capital structure and invest in an expansion of its fleet to capture unmet demand.

Al Dhaheri Capital Investment Group

Al Dhaheri Capital Investment Group was established in 1985 and is an extension of the old generation. Today, it leverages emerging technologies to invest in important sectors. It presently … READ MORE ...

Making Venture Capital Loans – Important Things That You Should Know

You have probably heard a lot lately about venture capital loans and how they can be so beneficial to entrepreneurs. But what exactly is a venture capital loan and what are its advantages over conventional loans? Well, you may already know that venture capital loans are a type of private loan given to an entrepreneur based on the success of their previous business venture. This means that they were able to successfully repay the loan in a shorter period. And this is the main advantage of venture capital loans – the fast turnaround time.

But then what are the disadvantages of venture capital loans? And why should you consider them instead of conventional loans? First of all, there is a very high risk involved with these kinds of loans. Since the venture capital funds will be coming from private sources, you have to take that much risk just to get it. And you are also required to give up part of your private equity when applying for a venture capital loan.

So how do you manage this risk? One thing you can do is to take out a loan at a lower interest rate than the usual market interest. You can also get a co-signer to back your venture capital loans. This way, even if you don’t pay the full amount of your venture capital loans, you don’t lose everything.

However, risks aside, you still have other disadvantages when it comes to venture capital investment. One of these is that … READ MORE ...

5 Benefits of Accepting Payments Using UPI Enabled Payment Gateway

Launched in 2016, Unified Payments Interface (UPI) has become the most popular payment option in the country. It has even left behind credit cards and debit cards in this aspect. This payment method allows customers to link their multiple bank accounts on a single platform, which is usually a simple mobile application, and make payments in seconds without filling in any banking details. Today, almost every other customer prefers to make payments using UPI rather than using any other option. This is the main reason why every business must use a UPI enabled payment gateway to make their operations frictionless. The best part is, you can easily find a free UPI gateway for which you don’t have to pay any additional charges. Keep reading to find out the 5 biggest benefits of using a UPI enabled payment gateway!

What Is UPI?

Unified Payments Interface is a real-time payment system designed and launched by the National Payments Corporation of India, with an aim to help users to make instant payments. It was launched back in 2016 and is powered by the Reserved Bank of India.

Soon after its launch, reputed local banks released their own UPI applications. And not just that, many third-party services like Google and Phonepe also launched their UPI apps, which are among the most used UPIs in the world today’s world.

Within a couple of weeks of launch, ICICI’s UPI app has crossed 1 lakh downloads, such as the popularity of this payment method. After some time, … READ MORE ...

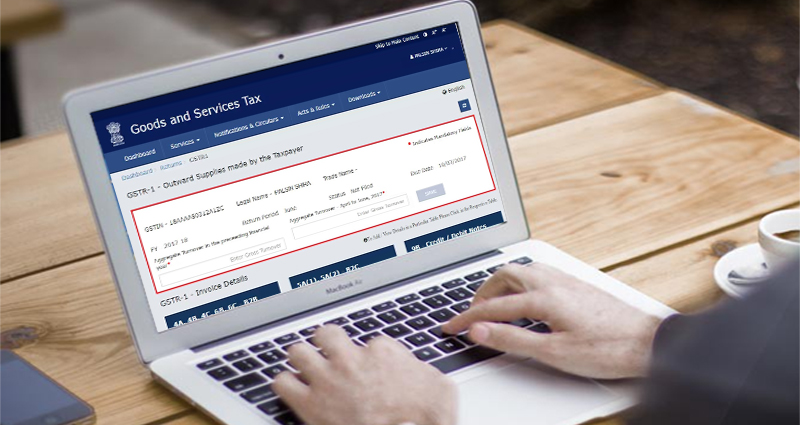

All You Need To Know About Gstr 1 Return Filing

The Goods and Services Tax has different types of systematic tax-paying methods. Gstr 1 return filing form is one of the many. It is a detailed tax return form that was introduced during the reformation and application of the Indian tax system through GSTN. Every registered taxpayer whose annual turnover is more than Rs 1.5 crore has to submit the outward supply details on the 11th of every month by filing gstr 1 return. Individuals whose turnover does not exceed more than 1.5 crores have to file the gstr 1 return quarterly.

What is Gstr 1?

As mentioned earlier, gstr 1 is a type of document where every registered taxpayer has to mention the details of their transactions. It is the initiation of processing input credit tax to the supplier. All the details of sales and supplying of goods need to be reported by the supplier during the tax period. It is also to be noted that even if there is no transaction that occurred in the entire month, the taxpayers still will have to submit gstr 1 return. Taxpayers can also continue submitting their invoices each month.

Who does not need to file gstr 1?

Following individuals are not obliged for gstr 1 return filing:

- Individual responsible to collect TDS

- Taxpayers eligible for TDS collection

- Online Information Database Access and Retrieval (OIDAR) Services suppliers

- Taxable individuals who are nonresidents

- Taxpayers registered under the GST composition plan

- Input Service Distributors (ISD)

Features of Gstr 1 return form

Following are the … READ MORE ...