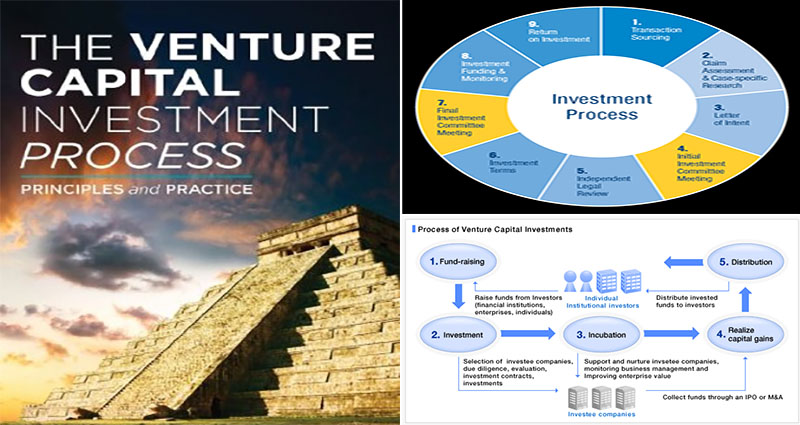

The initial phases of the VC process involve the look for investment possibilities and evaluating management teams. Afterward, the venture firm allocates its capital to businesses with powerful prospects. Most VC firms will hold a minority stake within the firms they invest in. Because of this, they will be far more most likely to become in a position to retain the high-quality people today on their Board of Directors. Additionally, the initial investment process involves a thorough assessment of the company’s business model, the marketplace potential, and the item or service.

Startup Stage

The initial stage of an organization comes immediately after the seed or startup stages. The item is now offered in the marketplace as well as investors can see how it performs. The initial stage also involves additional sales and manufacturing. The level of investment at this stage might be larger than in the preceding stages. The company requires to hold its own against the competitors and ensure that the new item can hold its worth. Within an initial couple of years of its life cycle, the business may have a likelihood to prove itself.

The Initial Stage

The subsequent stage of an enterprise is the 1st stage. This occurs immediately after the seed or startup stage. At this stage, the solution has already been developed and is out there within the market. This allows the investors to find out how it performs within the marketplace. Within this phase, the organization could also need added marketing and advertising, manufacturing, and sales. The amount of revenue spent at this stage is substantially greater than at the earlier stages. The business will have to compete with other organizations within this stage to help keep its worth.

The Term Sheet

The term sheet of a venture capital fund will usually demand the company to keep directors’ and officers’ liability insurance. The volume of coverage necessary by the investor will probably be specified in the term sheet. Some venture investors may also demand that the organization preserve important man life insurance policies. This will present money for the business in the case of the death of its founder. This money is usually employed to employ new talent for the firm. And, when the founder dies, the cash can be applied to hiring a replacement.

Venture Capital Investment Rounds

There are numerous sorts of venture capital investment rounds. The first round is generally probably the most crucial. It is typically essentially the most important investment round. Additionally, it truly is named the pre-money valuation and refers to the valuation of a firm ahead of it receiving new funds. The post-money valuation refers to the value of an organization just after it has received money from VCs. Usually, an enterprise with all the 1st stages of growth has been profitable for several years, and it features a high market share.

The Development Phase

The following step inside the venture capital process would be the development phase. Early-stage firms require funds for product improvement and marketing and advertising. A prosperous VC will invest within the development stage (Series A round). In this stage, the firm may have significantly less cash than it does at the end of the first round. On the other hand, a high-growth company is still an appealing investment for investors, because it presents very good returns. When the organization fails to grow beyond this point, it can not be lucrative for VCs.