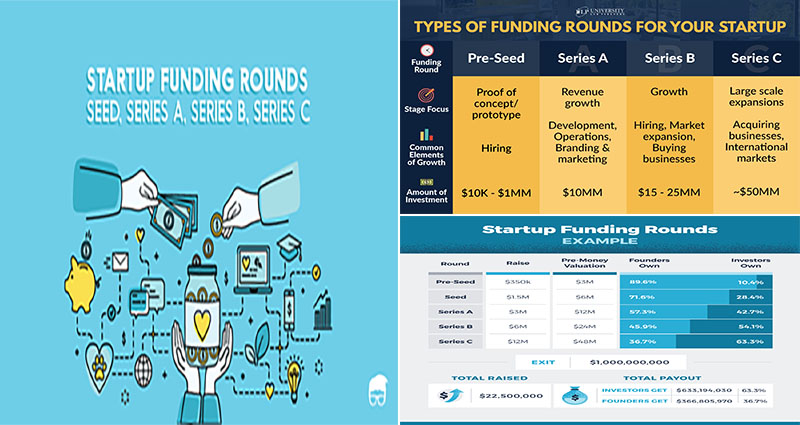

How to Get Seed Funding For Startups

Seed funding investors generally invest in early-stage ventures with high-risk prospective. This type of financing is created for startups using a viable item or service. Ahead of approaching a seed funding investor, make sure you realize the business model along with the costs linked with consumer acquisition and retention. In case you are unsure, use economic modeling tools or existing relationships to establish the likelihood of your product’s results. On the other hand, recall that this kind of investment entails higher danger.

The Market Prospective of the solution

Before picking a seed fund investor, entrepreneurs will have to be able to demonstrate the market prospective of their solution or service. They will have to explain how they will generate income with the item or service. Besides, investors desire to realize that the team is capable of functioning around the idea. Although you will discover several different seed funding avenues, the most regular route is through Venture Capitalists, a firm constructed particularly to supply funding to start-ups.

Preparing to Give Up Some Equity to Obtain Seed Funding

Aside from presenting the business program, entrepreneurs ought to prepare to give up some equity to obtain seed funding. An investor needs to be able to calculate a company’s market value determined by its equity structure. To do this, they will have to prepare a capitalization table that details all of their equity ownership capital. This table needs to show the total funding amount at various stages of development, person investment amounts, ownership shares, … READ MORE ...