Making the Office Work

Working an office job can often get monotonous and boring. You go to the same place and do the same things every day. If you are in charge of something like this, you may want to think about sprucing the office up to make it a more welcoming and exciting place to work. Here are three things you need to think about when it comes to the office.

The Lighting

The effect lights have on the spirit of your workers is underrated. Natural lighting is one of the most important things you can incorporate in your office. When your office is well-lit, it gives off an energy that will help workers get things done better and faster. It also reduces the chance of headaches for those who find themselves straining to see.

The Furniture

No office would be complete without the right furniture. Both workers and visitors need a place to sit and work when they come in. Even if you choose to buy both new and used office furniture, make sure you are buying quality pieces that will last. Don’t buy something just because it looks cool, buy it because it has a purpose. You don’t want the office overcluttered.

The Walls

What you have on your office walls can really set the tone for what attitude your workers will have. Brighter colored rooms can help bring happiness and energy when one comes into work every day. Putting artwork on the walls can help tie everything together and … READ MORE ...

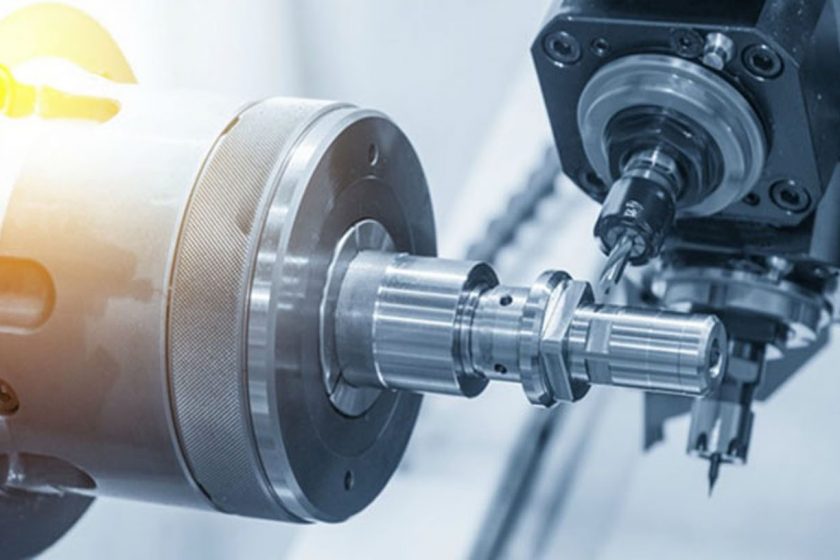

Why Parts Machining Is Important

In today’s fast-paced, technology-driven world, parts machining Zelienople PA has never been more important. Many essential industries rely on machined parts, including automotive, aerospace and medical. Without the precision of computer machining techniques, many modern comforts and conveniences would not be possible.

Precision Is Key to Quality Machining

A machined part is anything that is made through a process of removing material from a block of starting material, usually with very precise specifications and extremely low tolerances for deviation. It is this precision that makes many modern technologies possible – from car engines and airplane landing gear to electronics and medical implants.

Most parts machining is now computer numerical control, or CNC. Almost any material can be CNC machined, including metal, wood, plastic and foam. Because the CNC process uses a computer-generated CAD file and an automated cutting tool, it is highly accurate and precise – critical properties if a reliable car, airplane or MRI machine is to be built.

Critical Industries Rely on Machined Parts

Almost anything that is mechanical uses machined parts and many industries rely on precision machining to ensure proper fittings in engines, wheel bearings and valves. Custom medical implants and orthotics can be machined and even be made of disposable materials when sterile conditions are required. The transportation industry relies on machined parts to keep heavy-duty truck and train engines hauling cargo across the highways and railways. Precise, well-machined parts are also critical in space exploration, whether on a satellite or a manned spacecraft.… READ MORE ...

A How-to Guide to Planning Your Estate

Basic Background on Estates

An “estate” means the entirety of one’s possessions owned in a tangible and private property. In estates law, an individual’s estate usually means that the exact amount of property owned at the time of death before it’s been distributed. The main instrument which dictates what sort of estate will probably be distributed is often a will.

If an individual dies without a will, your estate will probably be divided based on state probate laws. For many people, it is of their welfare to devise a strategy regarding how their estate will be handled upon death. Relying on probate laws may lead to an unsatisfactory distribution of property upon death.

The goal of planning your estate or “estate planning” is to determine the transfer in your home upon death. In estate planning, it can be wise to talk with a professional like a lawyer who’s familiar with your background, preferences, and desires concerning the distribution of one’s assets.

What Estate Planning Covers

Estate planning is the reason for the administration of various matters after death, including, however, not restricted to:

Distribution of personal property to beneficiaries Allocation of property interests Choosing and identifying specific beneficiaries Directions regarding health care benefits and life insurance Provision for the care and guardianship of the minor children Organ donations if any Power of attorney delegations Instructions for addressing debt, if any Arrangements for funeral proceedings arrange for an estate is documented in a will. Again, this is far more preferable than … READ MORE ...

Local SEO And Other Business Advice From Top SEO Companies In Orlando

If you are a local business owner, one of the biggest challenges you face today is to optimize your website for voice search and mobile devices. Smartphones and tablets have become increasingly popular, so you have to find ways to make your website available to the millions of people using them. It is not enough to focus on having your website reach as many people as possible; you also need to reach those people at a fraction of the cost. This article will offer you several SEO tips for local businesses in Orlando FL that can help you succeed in your business.

If you own a business in Orlando FL and are trying to keep costs down, you may want to invest in voice-recognition technology for your websites. Some of the top SEO companies in Orlando FL can help you reach even more customers and increase your profit margin. Having your website available to voice search gives you a leg up over the competition and you may be able to save up to 90% off of what you would pay otherwise.

When a customer calls your business, they will tell the operator that they are looking for what they need on their website and then they will have the option to search by voice search. The voice search will bring up the results that your website has been optimized for voice search and it will allow the customer to choose which results they want to see. You may even have … READ MORE ...

3 Documents Every Graduating Senior Needs to Ensure Parents Can Intervene Medically For Them

It’s June and that means senior high school graduations. It also means many new adults in your midst. As your child steps into adulthood, you might not recognize that as a parent you will end up struggling to help your child with banking or gain access to help with their healthcare (while you can always be repaying correctly!).

Because your kids are a legal adult, HIPAA laws can prevent parents from making medical decisions on the child’s behalf. For that reason, parents of graduating seniors are urged to arrange ICE cards, an Advanced Healthcare Directive plus a HIPAA Authorization to be consulted and actively linked to the youngster’s care should their child become incapacitated or seriously injured within an accident, or simply need help navigating a healthcare claim while using the insurer.

Under current HIPAA laws, parents could be barred from making necessary medical and life-saving decisions on his or her child’s behalf without such documentation set up. Parents may further are unable to obtain necessary medical records with no Advanced Healthcare Directive.

Most parents assume they can make medical decisions on their own child’s behalf until they are legally married, that is hardly true. The law can prevent parents from getting involved with the care of a child 18 or older without explicit permission through legal documentation.

Parents of graduating seniors must complete the following documents which let them have permission to intervene medically to make life-saving decisions on their own child’s behalf:

1. ICE Card

ICE stands for … READ MORE ...