Capitalisation Tiers as Tactical Signals: Leveraging Small-, Mid-, and Large-Cap Behaviour in Portfolio Design

Investing is no longer about simply choosing “good” companies—it’s about understanding how those companies fit within a broader, strategically built portfolio. One often underappreciated lens through which investors can optimise their asset allocation is market capitalisation. By recognising the distinct behaviour of small-, mid-, and large-cap stocks, traders and portfolio managers can uncover tactical signals that guide more responsive, risk-aware strategies.

Market capitalisation tiers do more than categorise companies by size—they reflect different growth trajectories, levels of volatility, sector biases, and investor sentiment.

Understanding the Capitalisation Spectrum

Before diving into tactical uses, it’s essential to grasp what defines each capitalisation tier. Broadly speaking:

- Small-cap stocks typically represent companies with a market value between $300 million and $2 billion. These firms often operate in emerging industries or niche markets.

- Mid-cap stocks fall between $2 billion and $10 billion in market capitalisation. They often occupy a transitional space—no longer startups but not yet global giants.

- Large-cap stocks are generally valued at $10 billion or more. These are the household names with established track records and consistent revenues.

Each tier carries unique attributes in terms of risk, return potential, and behaviour in different market cycles. You can explore a detailed breakdown of these segments through this content, which offers a solid foundation for understanding their roles in equity investing.

Tactical Signals: Reading the Market Through Size

One of the key advantages of viewing capitalisation tiers as tactical signals is their tendency to outperform or underperform based on macroeconomic conditions and investor appetite … READ MORE ...

Differences Between Private Equity and Venture Capital Funding

While both private equity (PE) and venture capital (VC) firms invest in companies, they have distinct strategies, target different types of businesses, and operate at various stages of a company’s life cycle. Understanding these differences is crucial for founders, investors, and business professionals. The key distinction lies in the stage of the company they invest in and their approach to value creation.

Venture Capital: High-Growth, Early-Stage Investing

Venture capital is a form of private financing provided by VC firms to startups, early-stage, and emerging companies that have been deemed to have high growth potential or which have demonstrated high growth. VCs are structured to take a high-risk approach, knowing that a few successful investments in their portfolio will generate a massive return, covering the losses from many that fail.

- Investment Stage: VCs typically invest in companies at their earliest stages, from seed funding to Series A, B, and C rounds. At this point, the company may have a solid idea and a prototype, but little to no revenue or proven business model.

- Source of Funds: VCs manage pooled capital from limited partners (LPs), which include institutional investors like pension funds, university endowments, and family offices. They are accountable to these LPs and must follow a specific investment thesis.

- Value Creation: VCs primarily focus on helping a company scale rapidly. Their value-add often includes providing strategic guidance, leveraging their network to help with hiring and partnerships, and preparing the company for a future acquisition or initial public offering (IPO).

Top Capital Investors for Real Estate Development Projects

Securing capital for a real estate development project is a complex and highly competitive process. Unlike traditional property investments, development projects carry a higher risk profile due to construction, market, and entitlement uncertainties. As a result, developers often turn to specialized capital investors who understand these risks and can provide the necessary funding, strategic guidance, and industry connections.

Here are some of the top capital investors for real estate development projects, segmented by the types of capital they provide.

Institutional Investors and Private Equity Firms

These are among the largest and most significant players in the real estate development space. They manage massive funds for institutional clients and look to invest in large-scale projects with high-growth potential.

- Blackstone Group: As a global leader in private equity and real estate, Blackstone is a dominant force. They invest in a wide range of projects, from commercial office buildings and residential developments to logistics centers and hospitality properties. Their sheer size allows them to participate in multi-billion dollar deals, making them a top choice for major urban and large-scale projects.

- The Carlyle Group: Another global private equity powerhouse, Carlyle has a dedicated real estate platform. They are known for their strategic, value-add approach, often partnering with local developers to acquire and transform underperforming assets or to fund new, ground-up developments in high-demand markets.

- Brookfield Asset Management: Brookfield is a major investor in real estate, with a focus on large-scale, complex projects. They often invest in and operate properties, providing both capital and operational

How CMMC Could Affect Your Next DoD Contract Opportunity

The way companies win Department of Defense (DoD) contracts is changing, and it’s not just about having the right solution or lowest bid. The CMMC framework is quickly becoming a deciding factor, especially for companies aiming to stay competitive in regulated industries. If you’re eyeing your next DoD contract opportunity, understanding how the Cybersecurity Maturity Model Certification could shift the playing field is no longer optional—it’s a strategy move.

Early CMMC Levels Grant Access to DoD Opportunities

Even companies at the beginning stages of their cybersecurity journey can benefit from early CMMC certification levels. Level 1, for instance, is designed to cover basic cyber hygiene and is a requirement for contractors handling Federal Contract Information (FCI). Being certified at this level demonstrates your organization has the minimal protective measures in place, which opens the door to a wide range of entry-level DoD contracts that don’t require handling Controlled Unclassified Information (CUI).

What is CMMC doing at this early level? It’s acting like a gatekeeper. By having this foundational layer in place, contractors position themselves ahead of peers who haven’t yet made the commitment. For smaller firms or those new to DoD work, this could be the crucial step that moves a proposal from the discard pile to the consideration phase. And with increasing demand for CMMC compliance from federal agencies, early adopters are more likely to see recurring opportunities and build strong government relationships.

Level 2 Validation Unlocks New Contract Eligibility

Once your company moves from Level 1 to Level … READ MORE ...

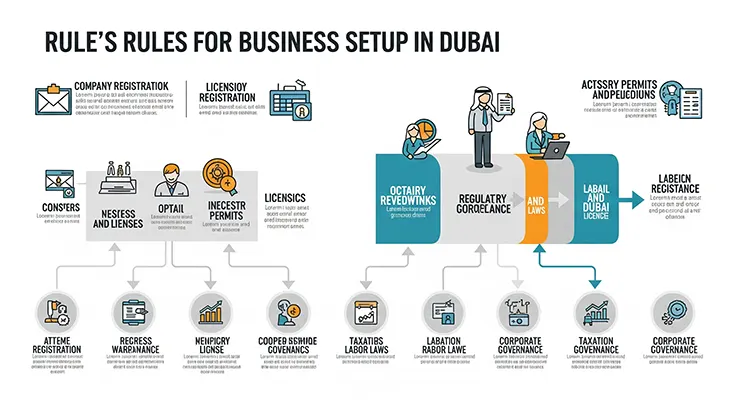

What are the rules for business setup in Dubai?

Key Takeaways:

- Choosing the right jurisdiction (mainland or free zone) and legal structure is the foundational rule for any Business setup in Dubai.

- 100% foreign ownership is now permitted for most mainland activities, eliminating the previous local partner requirement.

- All businesses must obtain a trade license from the Department of Economy and Tourism (DET) or a relevant Free Zone authority.

- Physical office space is generally mandatory, though flexible options exist in free zones.

- Businesses must comply with Corporate Tax (9% on profits over AED 375,000, 0% for qualifying free zone entities) and VAT (5%) regulations.

- Adherence to UAE Labor Law is essential for all employers, covering contracts, wages, working hours, and benefits.

Dubai has established itself as a leading global business hub, attracting entrepreneurs and investors from around the world. Its rapid growth and business-friendly policies are underpinned by a robust and evolving regulatory framework. Understanding “What are the rules for Business setup in Dubai?” is crucial for any aspiring business owner, as compliance with these regulations ensures a smooth, legal, and sustainable operation. These rules govern everything from initial registration to ongoing financial, operational, and employment obligations.

Rules for Jurisdiction and Legal Structure for Business setup in Dubai

The fundamental rules for a Business setup in Dubai begin with choosing where you will operate and what legal form your business will take. This decision has far-reaching implications for your operational scope, ownership, and regulatory obligations.

- Jurisdiction Choice (Mainland vs. Free Zone):

- Mainland: Companies licensed by the Department