How Long Does It Take To Build a Website: Website Builder Timeline

Website is a reflection of what your business is in the online world. Therefore, it is essential to have a good website that captures your brand essence, engages visitors, and provides a seamless user experience.

How long does it take to build such a website? You must have heard many claims that with NZ website builder, you can do it within a few hours or a week. While some website domain hosts brag, the actual time can differ significantly depending on various factors. Let us understand the website builder timeline for a decent webpage.

What is a Website Builder?

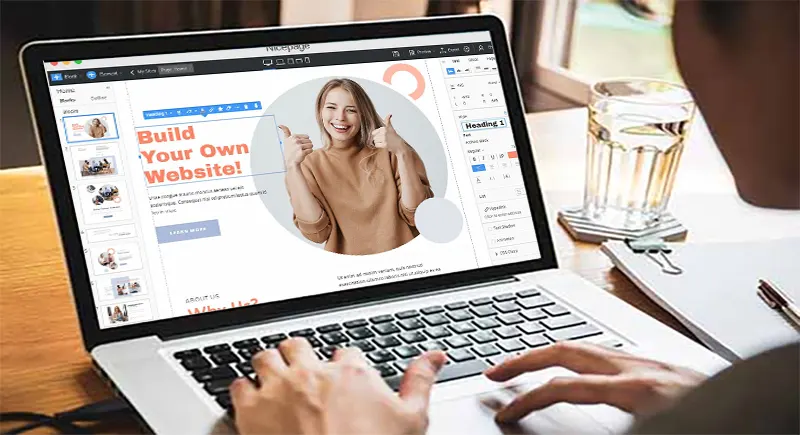

Website builder is a user-friendly option to build a website. With a simple drag-and-drop interface and customizable pre-loaded template, one can easily create a webpage. You don’t need a knowledge of coding, making it a beginner-friendly and speediest web design option.

You can adjust different elements by choosing a web design template, tailoring it and adding your content. Further, you don’t have to worry about the technical jargon, especially when you choose a web designer in NZ as your provider shall take care of it.

Timeline for Building a Website Using Website Builder

| Stages | Single-Page Website | Small eCommerce Site | Enterprise Website | |

| Time to Create | 4 hours – 3 days | 1 – 7 days | 5 – 14 weeks | |

| 1 | Planning and Requirements | 1 hour – 1 day | 2 hours – 3 days | 1 – 4 weeks |

| 2 | Design and Setup | 2 hours – 1 day | 4 hours – 2 |