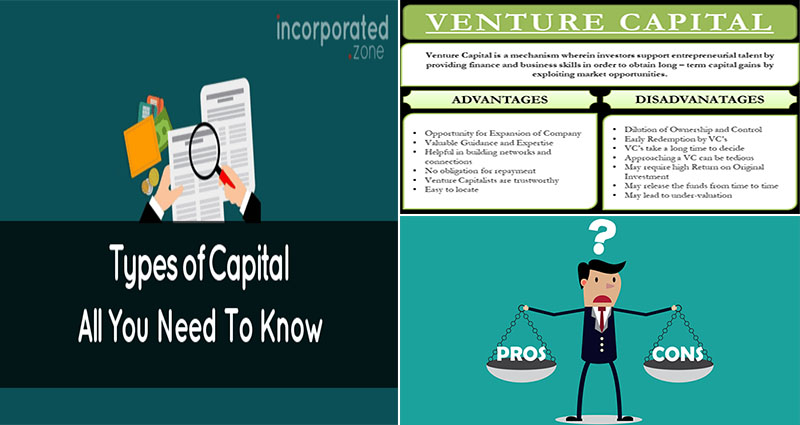

Types of Venture Capital Advantages and Disadvantages

You’ll find various types of venture capital. First-stage financing is a kind of early-stage funding that provides new businesses together with the required seed dollars to develop and marketplace their solution. Second-stage financing supplies enterprises with the funds to scale up, enter new markets, and improve promoting efforts. These types of financing are generally structured as debt or preferred stock, but typically have a higher rate of interest than earlier stages. For these causes, it can be crucial to understand the differences between the two.

Later-stage funding is presented to companies that have accomplished commercial results but are not however profitable. Bridge funding also referred to as mezzanine financing, aids smaller enterprises spend for short-term expenditures before an IPO or initial public providing. The corporations are usually high-risk/high-return and possess a history of producing a profit. You will discover two types of venture capital. Listed below are the key differences between the two.

The Very First Is Early-Stage Funding

This kind of capital is offered to new businesses having a strong opportunity of becoming sold. Lots of investment bankers are on the lookout for high-growth firms. This type of investment will normally create a big commission. These commissions can attain six to eight percent from the quantity raised via an IPO. VC investors typically look for high-risk/high-return enterprises. If these elements are present in your business enterprise, it can be crucial to locate the proper kind of funding.

Late-Stage Funding

It is supplied to corporations that have already accomplished commercial … READ MORE ...