The Goods and Services Tax has different types of systematic tax-paying methods. Gstr 1 return filing form is one of the many. It is a detailed tax return form that was introduced during the reformation and application of the Indian tax system through GSTN. Every registered taxpayer whose annual turnover is more than Rs 1.5 crore has to submit the outward supply details on the 11th of every month by filing gstr 1 return. Individuals whose turnover does not exceed more than 1.5 crores have to file the gstr 1 return quarterly.

What is Gstr 1?

As mentioned earlier, gstr 1 is a type of document where every registered taxpayer has to mention the details of their transactions. It is the initiation of processing input credit tax to the supplier. All the details of sales and supplying of goods need to be reported by the supplier during the tax period. It is also to be noted that even if there is no transaction that occurred in the entire month, the taxpayers still will have to submit gstr 1 return. Taxpayers can also continue submitting their invoices each month.

Who does not need to file gstr 1?

Following individuals are not obliged for gstr 1 return filing:

- Individual responsible to collect TDS

- Taxpayers eligible for TDS collection

- Online Information Database Access and Retrieval (OIDAR) Services suppliers

- Taxable individuals who are nonresidents

- Taxpayers registered under the GST composition plan

- Input Service Distributors (ISD)

Features of Gstr 1 return form

Following are the prerequisites of gstr 1 return form:

- Every individual who is filing gstr 1 return needs to be registered under the GSTIN with a 15-digit PAN-based GST number.

- The transaction details are to be kept with detailed invoices and unique serial numbers for every transaction. The transaction details should also include Business to Business (B2B), Business to Customer (B2C), interstate as well as intra-state details. Stock transfer between different business locations (out of state), non-GST supplies and transactions which are exempted also require declaration.

- Supplies provided towards a registered person, unregistered person, exempted, exports, advance received and non-GST supplies are all part of outward supplies.

- To verify the return, an OTP from the registered phone number is necessary, or you can also use a digital signature certificate of class 2 or higher. There is also an alternative process of using Aadhar based e-sign.

Late fee for filing Gstr 1 return after the due date

The updated late fine for gstr 1 in case of nil returns is Rs 50 per day and Rs 20 per day after the due date. As per the SGST Act and CGST Act the normal rate of the late fine was Rs 200.

How to fill Gstr 1 form

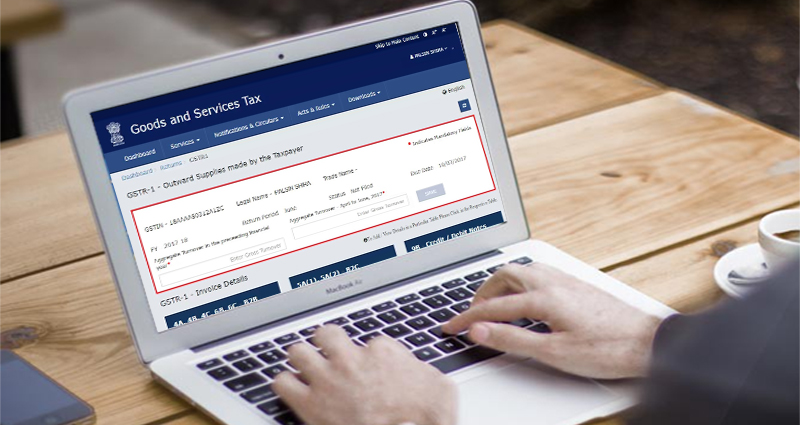

Unlike other gstr forms, gstr 1 filing is very detailed. A supplier has to bring forth all the sales and outward supplies. By following the given method a taxpayer can easily fill gstr 1 form:

- First, visit the official GST portal and log in.

- Look for the “Services” tab. From there, select “Return” and then “Return Dashboard”.

- Now go to the “Financial Year” option and select the financial year as well as the “Return Filing Period”. Select from the given options and then click the search button.

- Now there are two options, one is for quarterly and the other one is for monthly. It is a “yes” or “no” question. A taxpayer can choose what is ap[p[licable for him. Then click on the submit button.

- A pop up will be displayed on the screen showing either to proceed or cancel the confirmation. A success message will be displayed after the confirmation.

- Now look for the “Outward Suppliers” and other tabs, click on the “Prepare Online” for each of them and enter the particulars. Save while entering these data.

- One needs to keep in mind while providing these data that every section needs to be provided with exact data. For example, there are separate columns for B2B, B2C, etc. So every data has to be mentioned at their own places.

- After all the details are filled you need to click on “Generate GSTR 1 Summary”. Click on the acknowledgement box, then click “Submit”. Your details will be submitted.

Following this detailed instruction one can efficiently submit their gstr 1 return form. This list of instructions can help taxpayers fill the form without any hassle.