How Long Does It Take To Build a Website: Website Builder Timeline

Website is a reflection of what your business is in the online world. Therefore, it is essential to have a good website that captures your brand essence, engages visitors, and provides a seamless user experience.

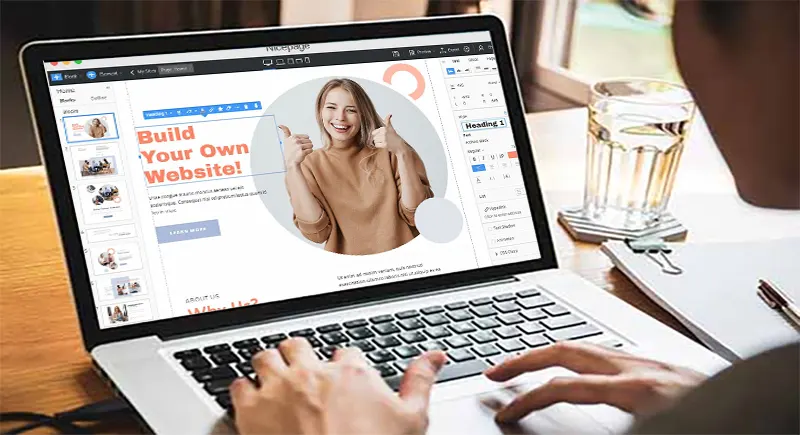

How long does it take to build such a website? You must have heard many claims that with NZ website builder, you can do it within a few hours or a week. While some website domain hosts brag, the actual time can differ significantly depending on various factors. Let us understand the website builder timeline for a decent webpage.

What is a Website Builder?

Website builder is a user-friendly option to build a website. With a simple drag-and-drop interface and customizable pre-loaded template, one can easily create a webpage. You don’t need a knowledge of coding, making it a beginner-friendly and speediest web design option.

You can adjust different elements by choosing a web design template, tailoring it and adding your content. Further, you don’t have to worry about the technical jargon, especially when you choose a web designer in NZ as your provider shall take care of it.

Timeline for Building a Website Using Website Builder

| Stages | Single-Page Website | Small eCommerce Site | Enterprise Website | |

| Time to Create | 4 hours – 3 days | 1 – 7 days | 5 – 14 weeks | |

| 1 | Planning and Requirements | 1 hour – 1 day | 2 hours – 3 days | 1 – 4 weeks |

| 2 | Design and Setup | 2 hours – 1 day | 4 hours – 2 |

Enhancing Efficiency with Filtered Doors: A Key Feature in Industrial Paint Booth Design

In the realm of paint spray booths and industrial paint booths, the quest for efficiency is perpetual. Every aspect of booth design and functionality is scrutinized for its potential to enhance productivity, reduce waste, and improve overall performance. One critical feature that often flies under the radar but plays a pivotal role in achieving these goals is the filtered door. In this comprehensive guide, we’ll delve into the importance of filtered doors in industrial paint booth design and how they contribute to enhancing efficiency in painting operations.

Understanding the Role of Filtered Doors

Filtered doors serve as the primary entry and exit points in industrial paint booths, providing access for personnel, equipment, and workpieces while maintaining environmental control. Unlike conventional doors, filtered doors are equipped with built-in filtration systems that capture overspray, dust, and other airborne contaminants, preventing them from escaping into the surrounding environment. This not only helps to maintain a clean and safe working environment but also ensures compliance with air quality regulations and standards.

Improving Airflow and Containment

One of the primary functions of filtered doors is to improve airflow and containment within the paint booth. By capturing overspray and particulate matter at the entrance and exit points, filtered doors help to maintain negative pressure inside the booth, preventing contaminants from escaping and contaminating adjacent areas. This is especially important in environments where strict cleanliness and contamination control are essential, such as automotive refinishing facilities and aerospace manufacturing plants.

Enhancing Coating Quality and Finish

In addition … READ MORE ...

Essential Pages to Build for Your eCommerce Website

Did you know, as per website design statistics, over half of the worldwide population prefers to read through a good-looking website. If they are given 15 minutes to browse through a website, 59% would prefer to do so on a website that is designed beautifully and logically. Wasn’t it a game-changer statistic for any business?

The idea is to design a website that creates a user-friendly experience with ease of navigation. But before planning your design and navigation or exploring domain and web hosting packages, it is essential to create a blueprint of your website with essential pages to build your eCommerce website.

So we are on the same page with regards to essential pages to build your eCommerce, then keep reading.

What is an eCommerce website?

An eCommerce website is basically an online shop that should provide engagement and be relatable to your customers.

Further, it should communicate your business overview with general info such as business photographs, testimonials/reviews, links to your social media, FAQ page, business policies, contact details, etc.

The most important aspect of an eCommerce website is that it should be easy to find and not cluttered and disorganised; therefore, it should be systematised and navigational to grab your customer’s attention.

Must-Have Pages for Your eCommerce Website

1. Homepage

A homepage creates the first impression of your eCommerce store; therefore, it must be not only appealing but also hook your visitors as soon as they land on your website.

It should provide primary information about … READ MORE ...

Navigating Market Volatility: Hedging Strategies with Listed Options

Market volatility can significantly impact the success of traders in the financial market. It refers to the unpredictable and sudden changes in market prices, which can cause substantial losses or gains for traders. As a result, traders need to have strategies in place to navigate market volatility effectively. One such approach is hedging, which involves taking positions that offset potential risks from other investments. In Singapore, traders can use hedging strategies when trading listed options to minimise their exposure to market volatility. This article will discuss how traders can navigate market volatility by using hedging strategies when trading listed options in Singapore.

Use of protective puts

Protective puts are a favoured hedging technique traders use to protect their investments from potential losses due to market volatility. This method involves purchasing put options, which give the holder the right to sell the underlying asset at a specified price within a specific time frame. By holding protective puts, traders can mitigate the risk of their investments decreasing in value due to market volatility. If the market price drops, the put option will increase in value, offsetting the losses incurred on the underlying asset.

The protection provided by protective puts can be especially beneficial for traders who have a long position on an investment and want to protect it from downside risk. Traders can also sell their put options if the market becomes less volatile, reducing their cost of hedging and increasing potential profits. However, traders should also consider the premium they pay … READ MORE ...

How to Start Investing in Stocks

Investing in stocks has long been a popular way to grow wealth. Australian investors have access to a robust and resilient market of potential investments. With its upswing economy, low levels of debt, and vital resource sector, the Australian stock market is an attractive destination for investors seeking growth opportunities.

While stock investing is not without risks, it can allow one to diversify their portfolio and benefit from capital gains over the long term. This article is intended to provide critical steps that Australian investors should consider when investing in stocks.

Research

The first step in investing in stocks is doing your research. You should become familiar with the various types of investments available and decide which best suits your goals. You must decide between growth and value stock investing as a starting point. Growth stocks are expected to outperform the general market due to their potential for strong earnings growth. Value stocks, on the other hand, tend to be undervalued compared to their peers and offer investors an opportunity to purchase them at attractive prices.

It is also essential to understand how different investment vehicles work, such as exchange-traded funds (ETFs), mutual funds, index funds, and individual stocks. ETFs are baskets of securities traded on exchanges just like individual stocks, while mutual funds pool money from several investors to purchase a portfolio of securities. Index funds are similar to ETFs but are passively managed, meaning that they track a market index rather than being actively traded. Individual stocks allow … READ MORE ...