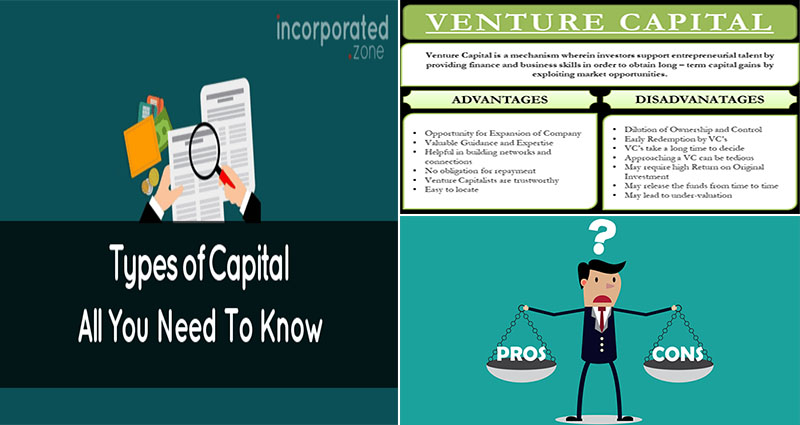

Venture Capital Firm Startup Definition

This article will discuss the different types of funding and their meanings for startups. In this article, you will learn about Mezzanine, Seed-stage, and First-round financing. Additionally, you will learn about the concept of Product-market fit. You will also learn about the importance of terms sheets. These documents describe the valuation, pro rata rights, and liquidation preference for investors. The next time you hear about a startup, read up on a definition of a venture capital firm.

Mezzanine financing

Mezzanine financing for a venture capital firm startup is one type of hybrid financing. In return for providing the startup with a large sum of money, mezzanine lenders collect interest on the loan and can exercise a warrant to acquire an equity stake in the company. Although the loan does not require equity, it can boost the investor’s rate of return. The terms of mezzanine financing can be very restrictive.

Seed-stage capital

Before obtaining seed-stage capital from a venture capital firm, the startup company must have a strong business plan. Many seed-stage startups have great ideas but no clue how to monetize them. In this stage, the company has a strong chance of success but is still at the earliest stages of development. A business plan can provide a clear roadmap for success. Here are some common reasons why seed- stage capital is necessary for a venture capital firm startup.

First-round financing

A first-round funding for venture capital firm startups is referred to as a Series A round. During this financing … READ MORE ...